A Quote by Jim Cramer

Whatever money you may need for the next five years, please take it out of the stock market right now, this week.

Related Quotes

Warren Buffett is right when he says you should invest as if the market is going to be closed for the next five years. The fundamental principles of value investing, if they make sense to you, can allow you to survive and prosper when everyone else is rudderless. We have a proven map with which to navigate. It sounds kind of crazy, but in times of turmoil in the market. I’ve felt a sort of serenity in knowing that if I’ve checked and rechecked my work, one plus one still equals two regardless of where a stock trades right after I buy it.

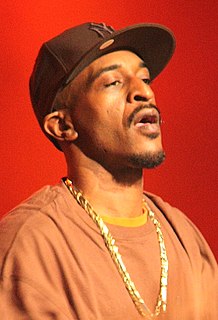

It might sound crazy but you put your money up and take out a little every week. You put yourself on a salary instead of getting $7,000 this week, $20,000 next week and $5,000 the week after that. Take a $1,000. You got your toys, you got everything and your money under your mattress. Break it down and have a salary to take care of you and your family and stretch that money.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

I've been very careful about what I say yes to and what I say no to. And I think seriously always about... this may be a good idea right now or it may be a lot of money right now, but will it be good for me five years from now? Will it be fun? Will it make me hate myself? I think about all of those things.

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.