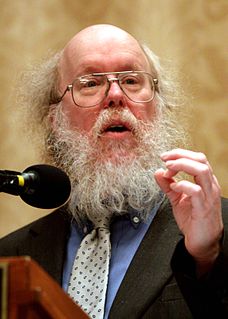

A Quote by Jim Justice

State government owes it to every taxpayer to be as fiscally responsible as possible.

Quote Topics

Related Quotes

However accurate or inaccurate the agency's numbers may be, tax law explicitly presumes that the IRS is always right -- and implicitly presumes that the taxpayer is always wrong -- in any dispute with the government. In many cases, the IRS introduces no evidence whatsoever of its charges; it merely asserts that a taxpayer had a certain amount of unreported income and therefore owes a proportionate amount in taxes, plus interest and penalties.

The subjects of every state ought to contribute toward the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state ....As Henry Home (Lord Kames) has written, a goal of taxation should be to 'remedy inequality of riches as much as possible, by relieving the poor and burdening the rich.'

Society in every state is a blessing, but government even in its best state is but a necessary evil; in its worst state an intolerable one; for when we suffer, or are exposed to the same miseries by a government, which we might expect in a country without government, our calamity is heightened by reflecting that we furnish the means by which we suffer.