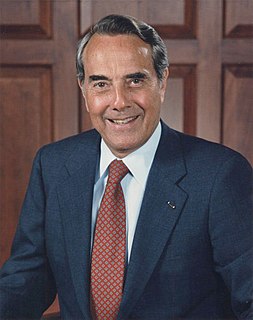

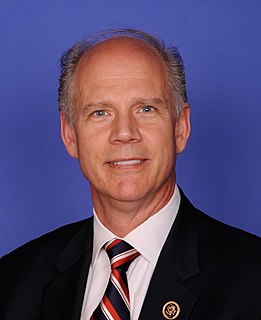

A Quote by Jim Sensenbrenner

Moreover, from reforming the tax code to our immigration system, to commonsense legal reform, President Bush put America on notice that he will continue fighting to make the country, and the world, a better place for future generations.

Related Quotes

As president, I will fight illegal immigration in order to preserve an appropriate level of legal immigration. At the same time, I believe our system of legal immigration needs to be re-examined. As part of this re-examination, I support a modest, temporary reduction in the annual rate of legal immigration.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

We really believe that we can bring about changes in the tax code that will make America more attractive for investment and job creation and business. But the president has also made it very clear that he wants to put - he wants to put new elements in the tax code that are going to have companies pay a price if they decide to take jobs out of the country and then sell their goods back into the United States.

There is no quick fix for illegal immigration. But only when we achieve better control of our borders and better respect for our immigration laws can we give meaning to the discussion we need to have over reforming the numbers, categories, and procedures for legal immigration into the United States.

Independent economists say immigration reform will grow our economy and shrink our deficits by almost $1 trillion in the next two decades. And for good reason: when people come here to fulfill their dreams - to study, invent, and contribute to our culture - they make our country a more attractive place for businesses to locate and create jobs for everyone. So let's get immigration reform done this year.