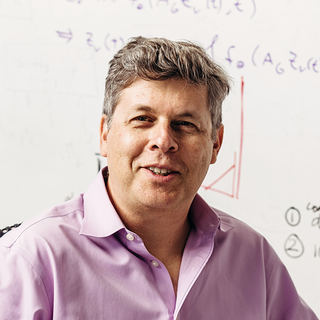

A Quote by Jim Stanford

We know that investment causes growth. But it is also true that growth causes investment.

Related Quotes

Investment in the eradication of hunger today is a good business decision. If we fail to make this investment, it is doubtful that we can sustain healthy economic growth. Without this investment, our nation may disintegrate into a country sharply divided between those who have enough to eat and those who do not.