A Quote by Jimmy Johnson

Two to three years down the road, other companies not on a model like Dell's will be in trouble.

Related Quotes

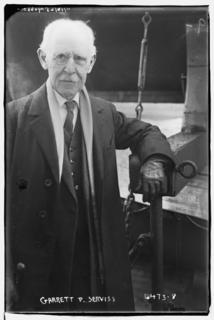

Mankind has tried the other two roads to peace - the road of political jealousy and the road of religious bigotry - and found them both equally misleading. Perhaps it will now try the third, the road of scientific truth, the only road on which the passenger is not deceived. Science does not, ostrich-like, bury its head amidst perils and difficulties. It tries to see everything exactly as everything is.

For instance, let us say that a new stock has been listed in the last two or three years and its high was 20, or any other figure, and that such a price was made two or three years ago. If something favorable happens in connection with the company, and the stock starts upward, usually it is safe play to buy the minute it touches a brand new high.