A Quote by Jodie Whittaker

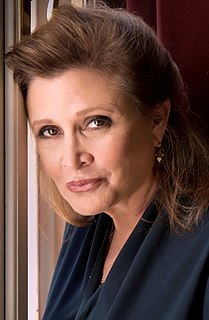

I avoid banks and I've never been in any sort of corporate environment at all.

Related Quotes

When anyone asks me how I can best describe my experiences of nearly forty years at sea, I merely say uneventful. I have never been in an accident of any sort worth speaking about....I never saw a wreck and have never been wrecked, nor was I ever in any predicament that threatened to end in disaster of any sort.

The financial crisis has underscored how insufficient attention to fundamental corporate governance concepts can have devastating effects on an institution and its continued viability. It is clear that many banks did not fully implement these fundamental concepts. The obvious lesson is that banks need to improve their corporate governance practices and supervisors must ensure that sound corporate governance principles are thoroughly and consistently implemented.

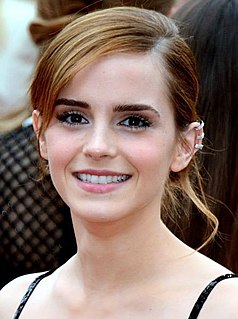

At a time when going to college has never been more important, it's never been more expensive, and our nation's families haven't been in this kind of financial duress since the great depression. And so what we have is just sort of a miraculous opportunity simply by stopping the subsidy to banks when we already have the risk of loans. We can plow those savings into our students. And we can make college dramatically more affordable, tens of billions of dollars over the next decade.

The catalyst that converts any physical location - any environment if you will - into a place, is the process of experiencing deeply. A place is a piece of the whole environment that has been claimed by feelings. Viewed simply as a life-support system, the earth is an environment. Viewed as a resource that sustains our humanity, the earth is a collection of places.

Business of blurring is fantastic. They both are playing the politics of avoidance. They avoid all the issues on corporate power, Iraq, Palestine, Israel, so on and so forth. They avoid all those. That's the politics of avoidance. All the major issues that are so much on people's minds - health care, living wage, public works, jobs - they avoid.

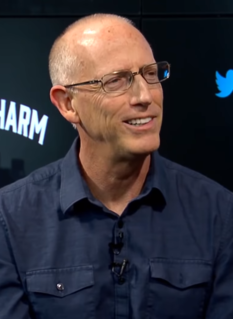

My failed corporate career became the fodder for the 'Dilbert' comic. Once it became clear I would not be climbing any higher on the corporate ladder, it freed me to mock managers without worrying that it would stall my career. Most failures create some sort of unplanned freedom. I took full advantage of mine.

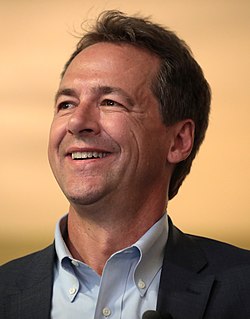

In Montana, no one, including out-of-state corporate executives, has been excluded from spending money - or 'speaking' - in our elections. Any individual can contribute. All we require is that they use their own money, not corporate money that belongs to shareholders, and that they disclose who they are.

Trump has been very, very open and clear on what he's going to do. He's going to make the U.S. very competitive on taxes, corporate and personal. He's eliminating policy on carbon and the regulatory environment on shale and energy and pipeline development. These are all things that Canada has to do and we no longer have a competitive environment to do them in. It manifests itself in the slow grind of our economy.

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.