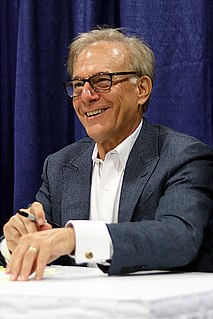

A Quote by Joe Klein

Bush the Elder's stature as president grows with every passing year. He was the finest foreign policy president I've ever covered and a man who defied his party on tax increases while imposing budget restrictions on the Democrats.

Related Quotes

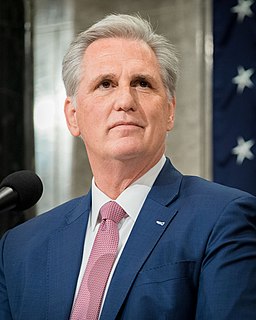

This is the first time a newly inaugurated president has had any impact on a current budget." What that means is that normally when a president's inaugurated in January, the budget for the first calendar year of his term or the first nine months is already done. So from January 21st all the way 'til October when the new budget's done, the president has to deal with the previous Congress' budget and has nothing to say about it. What they're saying is that Donald Trump has had a record-breaking, never-before-seen thing by having an impact on the budget in his first year.

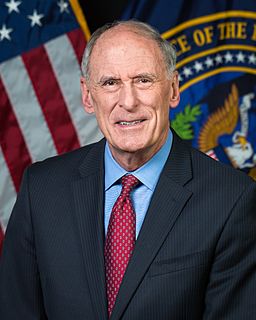

We pursued the wrong policies. George Bush is not on the ballot. Bill Clinton is not on the ballot. Mitt Romney is on the ballot, and Barack Obama is on the ballot. And Mitt Romney is proposing tax reform, regulatory reform, a wise budget strategy and trade. The president has proposed tax increases.

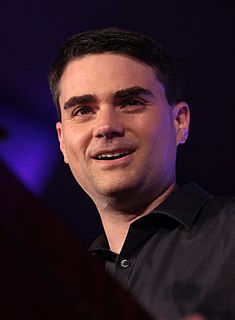

Every president inherits difficult problems. George W. Bush inherited eight years of a failed foreign policy and did nothing about the growing threat of Islamic terrorism, except a one-time lob of a cruise missile into the desert at a camp that had long been abandoned. George Bush inherited that, and 9-11 was the result of that. Every president inherits problems. Harry Truman inherited a war. Stop blaming the person before you and go forward and take leadership and deal with the problem.