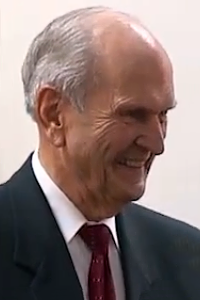

A Quote by Joe Mimran

There are different ways to raise capital that were not available when I was growing my business.

Quote Topics

Related Quotes

The purpose of finance is to enable business to acquire the ownership of capital instruments before it has saved the funds to buy and pay for them. The logic used by business in investing is things that will pay for themselves is not today available to the 95% born without capital. Most of us owe instead of own. And the less the economy needs our labor, the less able we are to "save" our way to capital ownership.

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

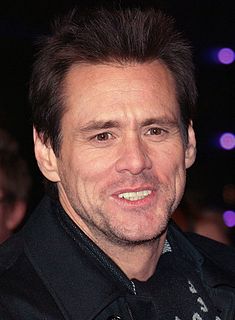

Well, he's got a much bigger circus to play with, and he has a lot more financing available, and he has a lot more time available. I think that makes a huge difference. I think he instinctively knows how to make films and all the different ways that you can make stuff. He's very gadget-wise, and he's very smart about all the different things that are available to a filmmaker nowadays, and he makes very good use of them. He has a theater in his house, for God's sake. It has proper curtains on it and everything. It's pretty wild.

I saw that we needed to grow but our top line wasn't growing, so we had to find other ways to grow the business. We had to reshape our business and acquire share in a non conventional way. But most tech leaders don't come out of a business background. They really have a parochial point of view. All they know are the go-go years of Silicon Valley. That's the environment in which they were raised.

I was encouraged to break all the rules but to take the best of philanthropy, the best of investing, and the best of development finance, and experiment with new ways to create this venture capital model of using philanthropy to back patient capital investments, and then build solutions that were measured in terms of the kind of impact and change they were making on people's lives and in the world, not just on the financial return.