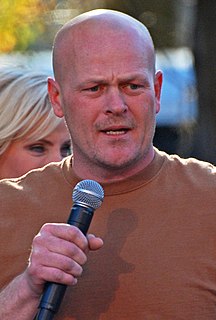

A Quote by Joe Wurzelbacher

You have to be taxed. Just because you work a little harder to have a little bit more money taken from you, I mean, that's scary. I worked hard for it. Why should I be taxed more than other people?

Related Quotes

Though tax records are generally looked upon as a nuisance, the day may come when historians will realize that tax records tell the real story behind civilized life. How people were taxed, who was taxed, and what was taxed tell more about a society than anything else. Tax habits could be to civilization what sex habits are to personality. They are basic clues to the way a society behaves.

When I was a teenager, the way some of these kids out here be actively gay, it would have been ridiculed in the hood. And now the hood is a bit more accepting. Begrudgingly accepting, but definitely more accepting than 20 years ago when I was a little kid. That doesn't mean that anybody should stop fighting for equality just because people are begrudgingly a little more accepting.

Being producer you're still going to have to sell somebody who's going to give you the money on the idea and everything like that. But it does give you a little bit more control if you're thinking in that creative process; it gives you more control to tell the story you want to tell rather than sort of just reading a script that somebody else wrote and says, "Yes, please, you can hire me for this job." So it's a little bit more hands-on, a little bit more closer to the heart.

I've always resented the smug statements of politicians, media commentators, corporate executives who talked of how, in America, if you worked hard you would become rich. The meaning of that was if you were poor it was because you hadn't worked hard enough. I knew this was a lite, about my father and millions of others, men and women who worked harder than anyone, harder than financiers and politicians, harder than anybody if you accept that when you work at an unpleasant job that makes it very hard work indeed.

When private industry makes a mistake, it gets corrected and goes away. As governments make mistakes, it gets bigger, bigger and bigger and they make more, more and more because as they run out of money, they just ask for more and so they get rewarded for making mistakes. In the meantime that is exactly what we are doing by subsidizing companies which are failing, we have a reverse Darwinism, we've got survival of the unfittest, the companies and people that have made terrible mistakes are being rewarded and other people are being punished and being taxed.