A Quote by Joel A. Barker

The invention of the micro-loan was a big surprise to me. Who would have guessed loans of less than $20 made to poor people in undeveloped countries could create thriving local economies? And, even more surprisingly, that they more reliably pay off their debts than the wealthy of the world.

Related Quotes

Roughly two billion people participate in the money economy, with less than half of those living in the wealthy countries of the developed world. These affluent 800 million, however, account for more than 75 percent of the world's energy and resource consumption, and also create the bulk of its industrial, toxic, and consumer waste.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

The world is not made of countries and outsiders. We are all just humans, and most of us fools and all of us longing for more than we have, to know more than we know--and yet even that is not enough, for if we knew everything we would only be disappointed that there was not one more secret to uncover.

SNAP benefits help local economies because the benefits are spent at local grocery stores - with locally grown and locally-made products. I remember many years ago, while on food stamps, I advocated for the benefits to be spent at local farmers markets - a move that has helped local economies even more.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

This is one way that wealthy Americans could really contribute. They could put hundreds of millions of dollars into the infrastructure bank, be a good investment for them, for their children, for their grandchildren, and they would directly contribute to revitalizing a big sector of middle-class wages in America and making our country more productive, so that we could create more opportunity. But I think that we could get a lot of grassroots support from, like, local chambers of commerce and other things if they understood exactly how this infrastructure bank would work.

We live in a world with serious class complexes. It is one thing to be a college student with loan debts and another thing to be just dirt poor for your entire life. The challenge is to come up with more complex understandings of where we are, more global awareness of what connects Americans with what is happening with suffering and oppressed people all around the world.

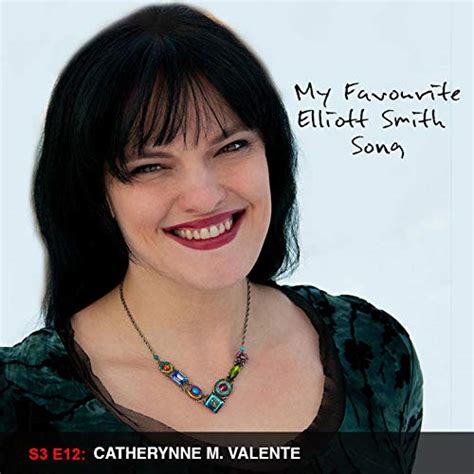

Abracadabra, thus we learn

The more you create, the less you earn.

The less you earn, the more you're given,

The less you lead, the more you're driven,

The more destroyed, the more they feed,

The more you pay, the more they need,

The more you earn, the less you keep,

And now I lay me down to sleep.

I pray the Lord my soul to take

If the tax-collector hasn't got it before I wake.

Somehow, the fact that more poor people are on welfare, receiving more generous payments, does not seem to have made this country a nice place to live - not even for the poor on welfare, whose condition seems not noticeably better than when they were poor and off welfare. Something appears to have gone wrong; a liberal and compassionate social policy has bred all sorts of unanticipated and perverse consequences.