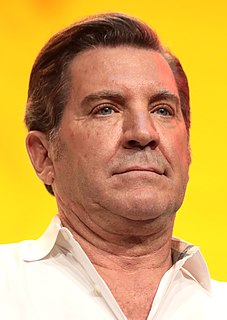

A Quote by Joel C. Rosenberg

The glue that kept the consumer market together the last few years was the wealth effect from the housing boom.

Related Quotes

We create these boom-bust cycles by manipulating the money supply and the interest rates and directing it where it went in. And that is what happened with housing: pushed into housing combination of easy money plus all the regulations, and we created this boom-bust cycle, and corruption, because corruption goes with it, because you don't have the same discipline. So we've got to stop all that.

I have concluded that most PhD economists under appraise the power of the common-stock-based "wealth effect," under current extreme conditions... "Wealth effects" involve mathematical puzzles that are not nearly so well worked out as physics theories and never can be... What has happened in Japan over roughly the last ten years has shaken up academic economics, as it obviously should, creating strong worries about recession from "wealth effects" in reverse.

During the last two years the wealthiest 14 Americans saw their wealth increase by $157 billion. This is truly unbelievable. This $157 billion INCREASE in wealth among 14 individuals is more wealth that is owned, collectively, by 130 million Americans. This country does not survive morally, economically or politically when so few have so much, and so many have so little.