A Quote by Joel Greenblatt

The more confidence I have in each one of my stock picks, the fewer companies I need to own in my portfolio to feel comfortable.

Related Quotes

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

What this country needs is more people to inspire others with confidence, and fewer people to discourage any initiative in the right direction more to get into the thick of things, fewer to sit on the sidelines, merely finding fault more to point out what's right with the world, and fewer to keep harping on what's wrong with it and more who are interested in lighting candles, and fewer who blow them out.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.

Unfortunately our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very-very strong balance sheet with huge value drivers at the end of it.

We've got a portfolio of companies that range all the way from hotels to television stations and cable TV companies, oil and gas, consumer products, and industrial products. If there's anything that I want to know more about, I have the opportunity. It's right in our portfolio. I can spend time at the factory or with the manangement and learn as much as I want. You can't get bored doing that.

This is not the kind of country where you would feel comfortable if you were opposed to democracy, parliamentary law, independent courts and so I would say to people who don't feel comfortable with those values there might be other countries where they'd feel more comfortable with their own values or beliefs.

There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically. The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

In going directly to Investment Heaven, you build your portfolio as you would build a wonderful company through a merger and acquisition program. You specify the way you want your portfolio to look, and then you assemble the profile piece by piece by bringing together companies that make their own individual contributions to the desired character.

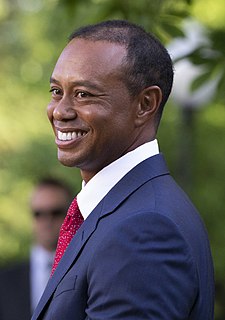

Courses that you've had success on, all of a sudden your game turns around because you feel comfortable on your tee shots, you feel comfortable going to the greens, you know, all the reads on the putts. It's a feeling that's hard to describe, but it's certainly one that you get filled up with confidence more than anything else.