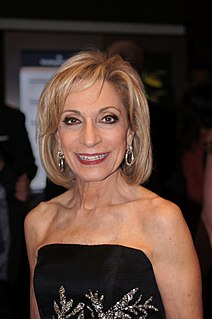

A Quote by Joel Spolsky

Full service brokers, in this day and age of low cost mutual funds and discount brokers, are really nothing more than machines for ripping off retail investors.

Related Quotes

Mutual funds charge 2% per year and then brokers switch people between funds, costing another 3-4 percentage points. The poor guy in the general public is getting a terrible product from the professionals. I think it's disgusting. It's much better to be part of a system that delivers value to the people who buy the product. But if it makes money, we tend to do it in this country.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

Invest in low-turnover, passively managed index funds... and stay away from profit-driven investment management organizations... The mutual fund industry is a colossal failure... resulting from its systematic exploitation of individual investors... as funds extract enormous sums from investors in exchange for providing a shocking disservice... Excessive management fees take their toll, and manager profits dominate fiduciary responsibility.

Millions of mutual-fund investors sleep well at night, serene in the belief that superior outcomes result from pooling funds with like-minded investors and engaging high-quality investment managers to provide professional insight. The conventional wisdom ends up hopelessly unwise, as evidence shows an overwhelming rate of failure by mutual funds to deliver on promises.

The general systems of money management today require people to pretend to do something they can't do and like something they don't. It's a funny business because on a net basis, the whole investment management business together gives no value added to all buyers combined. That's the way it has to work. Mutual funds charge two percent per year and then brokers switch people between funds, costing another three to four percentage points. The poor guy in the general public is getting a terrible product from the professionals.