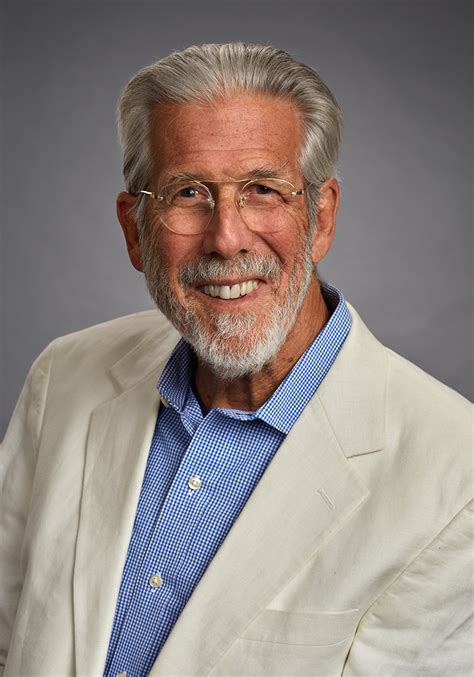

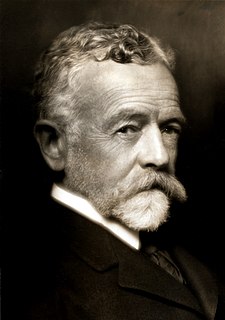

A Quote by John Buchanan Robinson

There is never enough gold to redeem all the currency in circulation.

Related Quotes

We were not foolish enough to try to make a currency [backed by] gold of which we had none, but for every mark that was issued we required the equivalent of a mark's worth of work done or goods produced ... we laugh at the time our national financiers held the view that the value of a currency is regulated by the gold and securities lying in the vaults of a state bank.

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.

Government, possessing the power to create and issue currency and credit as money and enjoying the right to withdraw both currency and credit from circulation by taxation and otherwise, need not and should not borrow capital at interest as a means of financing government work and public enterprises.

No duty is more imperative for the government than the duty it ;owes the people to furnish them with a sound and uniform currency, an of regulating the circulation of the medium of exchange so that labor will be protected from a vicious currency [private bank-created, interest-bearing debt], and commerce will be facilitated by cheap and safe exchanges.

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.

Most paper money initially existed as a substitute for gold. That's what gave it value. But right now what gives a currency value is other currency. Most countries hold reserves and the reserves are other currencies. If you are a backing up the euro with the dollar, what's backing up the dollar? I don't think it is going to go to a point where all you have is coins and bars of gold, but I do think that we are going to have to go back to a monetary system based in gold, not based on paper.