A Quote by John Buchanan Robinson

At present, financial crises occur, chiefly because the paper currency is redeemable in gold only.

Related Quotes

The available supply of gold and silver being wholly inadequate to permit the issuance of coins of intrinsic value or paper currency convertible into coin of intrinsic value or paper currency convertible into coin in the volume required to serve the needs of the People, some other basis for the issue of currency must be developed, and some means other than that of convertibility into coin must be developed to prevent undue fluctuation in the value of paper currency or any other substitute for money intrinsic value that may come into use.

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.

Most paper money initially existed as a substitute for gold. That's what gave it value. But right now what gives a currency value is other currency. Most countries hold reserves and the reserves are other currencies. If you are a backing up the euro with the dollar, what's backing up the dollar? I don't think it is going to go to a point where all you have is coins and bars of gold, but I do think that we are going to have to go back to a monetary system based in gold, not based on paper.

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

Prior to 1968, the gullible gentiles could take a one dollar Federal Reserve note into any bank in America and redeem it for a dollar which was by law a coin containing 412 1/2 grains of 90 per cent silver. Up until 1933, one could have redeemed the same note for a coin of 25 4/5ths grains of 90 per cent gold. All we do is give the goy more non-redeemable notes, or else copper slugs. But we never give them their gold and silver. Only more paper.

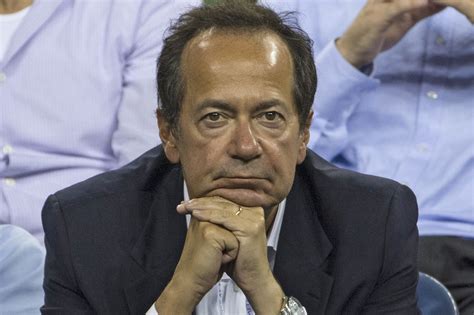

Gold is unique because it has the age-old aspect of being viewed as a store of value. Nevertheless, it’s still a commodity and has no tangible value, and so I would say that gold is a speculation. But because of my fear about the potential debasing of paper money and about paper money not being a store of value, I want some exposure to gold.