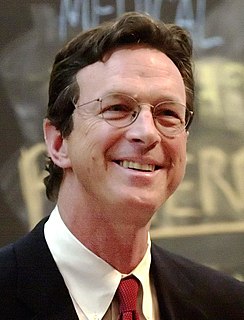

A Quote by John C. Bogle

My biggest prediction for the future is that people are going to start looking after individual investors.

Quote Topics

Related Quotes

When you start to do research into gorillas or any kind of apes, if you're going to play them, that's one of the biggest misconceptions. And when I did Kong, you're not doing gorilla movements, you're not doing ape movements, you're looking for a personality. It's like saying okay I'm going to do human movements.

The book known by the name of the Apocalypse, has seemed to be until now unintelligible, merely because people persisted to see in it a real prediction of the future, which every one has explained after his own fashion, and in which they have always found what they wanted, namely anything but that, what the book contained.