A Quote by John C. Bogle

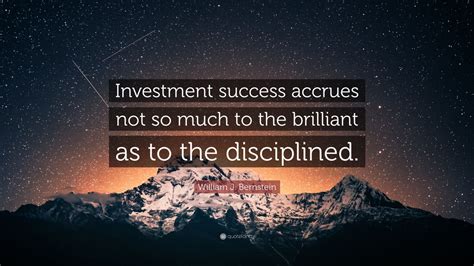

The stock market is a giant distraction to the business of investing.

Quote Topics

Related Quotes

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

An index fund is a fund that simply invests in all of the stocks in a market. So, for example, an index fund might invest in every single stock or almost every single stock in the U.S. market, it might invest in every single stock abroad, or it might invest in all of the bonds that are out there. And you can make a perfectly fine investing portfolio that mixes equal parts of all three of those.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

There are three important principles to Graham's approach. [The first is to look at stocks as fractional shares of a business, which] gives you an entirely different view than most people who are in the market. [The second principle is the margin-of-safety concept, which] gives you the competitive advantage. [The third is having a true investor's attitude toward the stock market, which] if you have that attitude, you start out ahead of 99 percent of all the people who are operating in the stock market - it's an enormous advantage.