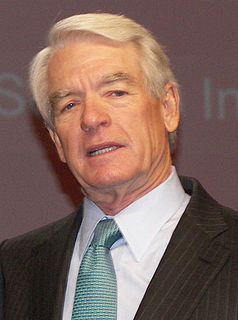

A Quote by John C. Bogle

Related Quotes

To value investors the concept of indexing is at best silly and at worst quite hazardous. Warren Buffett has observed that "in any sort of a contest - financial, mental or physical - it's an enormous advantage to have opponents who have been taught that it's useless to even try." I believe that over time value investors will outperform the market and that choosing to match it is both lazy and shortsighted.

So smile when you read a headline that says "Investors lose as market falls." Edit it in your mind to "Disinvestors lose as market falls-but investors gain." Though writers often forget this truism, there is a buyer for every seller and what hurts one necessarily helps the other. (As they say in golf matches: "Every putt makes someone happy.")

As a bull market turns into a bear market, the new pros turn into optimists, hoping and praying the bear market will become a bull and save them. But as the market remains bearish, the optimists become pessimists, quit the profession, and return to their day jobs. This is when the real professional investors re-enter the market.

Successful investors tend to be unemotional, allowing the greed and fear of others to play into their hands. By having confidence in their own analysis and judgement, they respond to market forces not with blind emotion but with calculated reason. Successful investors, for example, demonstrate caution in frothy markets and steadfast conviction in panicky ones. Indeed, the very way an investor views the market and it’s price fluctuations is a key factor in his or her ultimate investment success or failure.

The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know anybody who knows anybody who has done it successfully and consistently. Yet market timing appears to be increasingly embraced by mutual fund investors and the professional managers of fund portfolios alike.