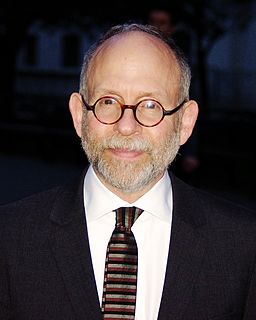

A Quote by John C. Bogle

Vanguard never would have happened if I hadn't been fired as CEO of Wellington Management Company, the firm that did the investing for the Wellington fund and eight sister funds.

Related Quotes

The culture of the mutual fund industry, when I came into it in 1951, was pretty much a culture of fiduciary duty and investment, with funds run by investment professionals. The firm I worked with, Wellington Management Co., they had one fund. That was very typical in the industry... investment professionals focused on long-term investing.

The most common mistakes were investing in money market funds by people who were so scared at the prospect of managing their own funds that they picked the most conservative option, and their investments did not keep up with inflation. The second major mistake was being too heavily invested in their own company's stock, and buying when it was high and there was a lot of optimism about the company, and then having to sell it low when the company got in trouble.

Invest in low-turnover, passively managed index funds... and stay away from profit-driven investment management organizations... The mutual fund industry is a colossal failure... resulting from its systematic exploitation of individual investors... as funds extract enormous sums from investors in exchange for providing a shocking disservice... Excessive management fees take their toll, and manager profits dominate fiduciary responsibility.