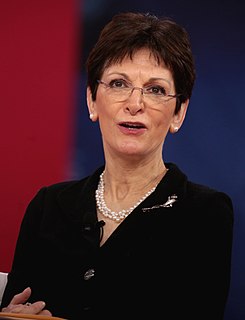

A Quote by John C. Dvorak

The stock market goes nuts over any company that so much as mentions the word Internet. All this proves to me is that the boneheads on Wall Street are as dumb as they were in college when they had to switch their majors to business to keep from flunking out.

Related Quotes

In the summer between my freshman and sophomore year, my grandfather got me a job at a local messenger company working on Wall Street. I was lucky enough to have been in the business during a stock market boom but just before the fax machine appeared on the scene, let alone email and the Internet. As a result, the messenger business was booming.

Look at what's happening between Main Street and Wall Street. The stock market index is up 136 percent from the bottom. Middle class jobs lost during the correction: six million. Middle class jobs recovered: one million. So therefore we're up 16 percent on the jobs that were lost. These are only born-again jobs. We don't really have any new jobs, and there's a massive speculative frenzy going on in Wall Street that is disconnected from the real economy.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

To prove that Wall Street is an early omen of movements still to come in GNP, commentators quote economic studies alleging that market downturns predicted four out of the last five recessions. That is an understatement. Wall Street indexes predicted nine out of the last five recessions! And its mistakes were beauties.