A Quote by John Delaney

My general view is that capitalism is an amazing innovation and job-creation machine. But what we've done historically that has been so brilliant is that we've moderated it with appropriate tax policy, with regulation, with workers' rights and infrastructure in our society that make sure that everyone has an opportunity.

Related Quotes

If we look at Germany's infrastructure policy, it has been driven by its mission-oriented focus on green infrastructure. This affects both innovation and infrastructure, old industries and new. The German steel industry, for example, has adapted to the policy by lowering its material content through a 'repurpose, reuse and recycle' strategy.

Our infrastructure of bridges, roads and ports has been given a D-level rating by many civil engineer societies. The government should shift some money from the Defense budget and hire companies to fix our infrastructure. As for non-construction workers, we need to do job retraining in those growing areas where more skilled workers will be needed.

Now it is unambiguously clear that trickle-down economics does not work. But what does that mean? That means we have to structure our economic policies to make sure that we have shared prosperity. And you don't do that by giving a tax cut to the big winners and raising taxes on those who have not done very well. Your economic policy has to respond to the way our economic system has been working.

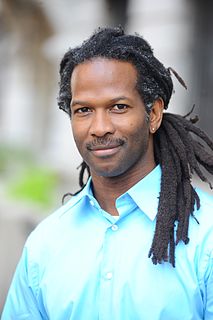

The policy that received more attention particularly in the past decade and a half or so has been the US cocaine policy, the differential treatment of crack versus powder cocaine and question is how my research impacted my view on policy. Clearly that policy is not based on the weight of the scientific evidence. That is when the policy was implemented, the concern about crack cocaine was so great that something had to be done and congress acted in the only way they knew how, they passed policy and that's what a responsible society should do.

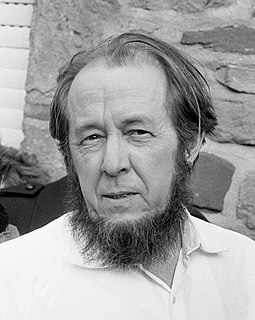

Human rights' are a fine thing, but how can we make ourselves sure that our rights do not expand at the expense of the rights of others. A society with unlimited rights is incapable of standing to adversity. If we do not wish to be ruled by a coercive authority, then each of us must rein himself in...A stable society is achieved not by balancing opposing forces but by conscious self-limitation: by the principle that we are always duty-bound to defer to the sense of moral justice.

Governments will always play a huge part in solving big problems. They set public policy and are uniquely able to provide the resources to make sure solutions reach everyone who needs them. They also fund basic research, which is a crucial component of the innovation that improves life for everyone.