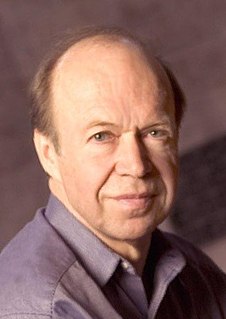

A Quote by John Dingell

Nobody in this country realizes that cap-and-trade is a tax - and it's a great big one.

Related Quotes

Eventually we'll use a CO2 tax offset by a reduction in taxes elsewhere alongside a cap-and-trade plan, but the degree of difficulty associated with a CO2 tax far exceeds that with a cap-and-trade plan. We're seeing it's hard to get a cap-and-trade plan and it's much easier to use as a basis for a global agreement than a CO2 tax.

To some, a cap-and-trade system might sound like a neat approach where the market sorts everything out. But in fact, in some ways it is worse than a tax. With a tax, the costs are obvious. With a cap-and-trade system, the costs are hidden and shifted around. For that reason, many politicians tend to like it. But that is dangerous.

[Barack] Obama, for example, he has not given up on cap-and-trade. Now, he has not been able to pass cap-and-trade, but cap-and-trade is all about redistribution of wealth in a global basis - taking money out of this country and giving it to third-world countries on the other end of the ocean. And that is redistribution of wealth in a global basis. It's fundamental Marxism.

I'm not shy about stating my opinion on political issues, so I can state my opinion, which is, on this one, Premier Notley's right. Because cap and trade systems have not been shown to work. And if you want to price carbon, then I would listen to the CEO of Suncor, who suggests a clean, transparent carbon tax makes a bunch more sense than a cap and trade system that just creates jobs for traders. I - I kind of agree with that.

There's such a wide variation in tax systems around the world, it's difficult to imagine a harmonized CO2 tax that every country agrees to. That's not in the cards in the near term. But the countries that are doing the best job, like Sweden, are already doing both of these. I think that eventually we'll use both of them but we need to get started right away and the cap-and-trade is a proven and effective tool.

Our country is in serious trouble. We don't win anymore.We don't beat China in trade. We don't beat Japan, with their millions and millions of cars coming into this country, in trade. We can't beat Mexico, at the border or in trade.We can't do anything right. Our military has to be strengthened. Our vets have to be taken care of. We have to end Obamacare, and we have to make our country great again, and I will do that.