A Quote by John Elkann

I think there is empirical evidence that if you look at family controlled businesses, they actually outperform in terms of results and also valuations, the broader market.

Related Quotes

You don't actually find a strong correlation between- top-line GDP growth and making money in the market. It- it seems like you should. The fastest-growing countries should give you the highest return. They simply don't. But, there's only four of us- that- that believe that story. Everyone else in the world believes that if you grow fast like China, you'll outperform in the stock market.

Berkshire's whole record has been achieved without paying one ounce of attention to the efficient market theory in its hard form. And not one ounce of attention to the descendants of that idea, which came out of academic economics and went into corporate finance and morphed into such obscenities as the capital asset pricing model, which we also paid no attention to. I think you'd have to believe in the tooth fairy to believe that you could easily outperform the market by seven-percentage points per annum just by investing in high volatility stocks.

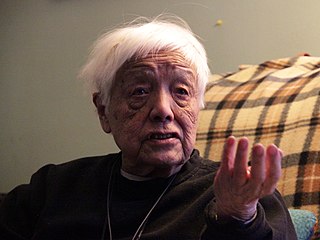

When you think of power, you think the state has power. When you look at it in terms of revolution, in terms of the state, you think of it in terms of Russia, the Soviet Union, and how those who struggled for power actually became victims of the state, prisoners of the state, and how that led to the dissolution of the Soviet Union. We have to think of revolution much more in terms of transitions from one epoch to another. Talk about Paleolithic and Neolithic.

When you think of power, you think the state has power. When you look at it in terms of revolution, in terms of the state, you think of it in terms of Russia, the Soviet Union, and how those who struggled for power actually became victims of the state, prisoners of the state, and how that led to the dissolution of the Soviet Union. We have to think of revolution much more in terms of transitions from one epoch to another.

In New Zealand, sex workers are regarded as workers, as people who are members of the community, people who have a stake in the community - not just in the workplace, but in the broader community. They aren't objects to be controlled and regulated. They are not collateral evidence of a crime. They are human beings.