A Quote by John Fund

There have been brilliant satires about the tax bureaucracy before, from the Beatles song ‘The Taxman’ to the film ‘Harry’s War,’ but in some ways Jim Greenfield’s The Taxman Cometh outdoes them all. His tale of a little guy who can’t take it anymore is both compelling and timely, given the tax scandals we read about in Washington almost every day.

Related Quotes

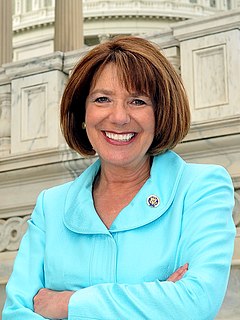

This thought-provoking novel portrays the absurdity of our overbearing government bureaucracy with a story that is entertaining and fast-paced. The Taxman Cometh will become part of our national dialogue about taxes and freedom. And it’s funny as hell. Author Jim Greenfield is a cross between Ayn Rand and Monty Python. If enough people read this hilarious ‘man versus state’ book, the IRS will be put out of business, which is okay with me.

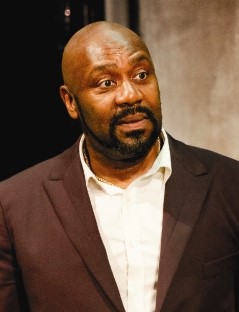

Jim Greenfield’s The Taxman Cometh will undoubtedly put a smile on the face of even the most dedicated big government freeloader. In the ‘Everyone Deserves a Trophy’ society we live in, it’s refreshing to know that Jim’s literary voice will cut through the politics, using the American spirit of a used car dealer.

Obama does not believe in individual upward mobility. He would penalize it, tax it, regulate it, inveigh against it and disincentivize it. We will be like salmon swimming upstream to mate. We will overcome the currents, the waterfall, the rocks and the predators, and will grapple our way up the stream. Then, at the top of the waterfall will stand Obama the Bear, waiting to scoop us up and have us for dinner. The taxman cometh.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

I don't think this is a situation where you can say that Congress was avoiding any mention of the tax power. It'd be one thing if Congress explicitly disavowed an exercise of the tax power. But given that it hasn't done so, it seems to me that it's - not only is it fair to read this as an exercise of the tax power, but this court has got an obligation to construe it as an exercise of the tax power if it can be upheld on that basis.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.