A Quote by John Hagee

If your investments are limited to this earth, you are the world's worst investor.

Related Quotes

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

If you're going to be an investor, you're going to make some investments where you don't have all the experience you need. But if you keep trying to get a little better over time, you'll start to make investments that are virtually certain to have a good outcome. The keys are discipline, hard work, and practice. It's like playing golf - you have to work on it.

Guy Ritchie is the worst screenwriter in the world, but, to be fair, he is not the worst director. He is only the worst director of the people who actually get to make movies. As we speak, there are human beings walking the Earth - perhaps as many as a half dozen of them - with less directorial talent, but they've been safely diverted into other activities.

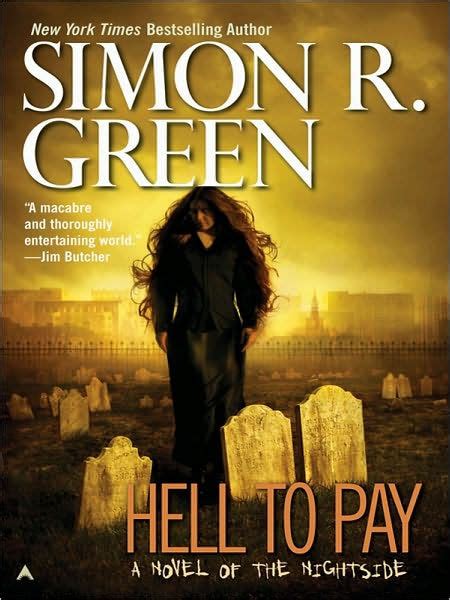

We are in the dark places of the earth," said Madman. "Where all the ancient and most dangerous secrets are kept. There are Old Things down here, sleeping all around us, in the earth and in the living rock, and in the spaces between spaces. Keep your voices down. Some of these old creatures sleep but lightly, and even their dreams can have force and substance in our limited world. We have come among forgotten gods and sleeping devils, from the days before the world settled down and declared itself sane.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.