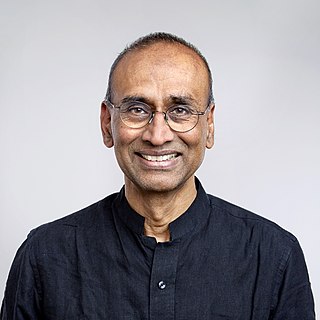

A Quote by John Hull

Our tree is actually a tree of the short-term interest rate. The average direction in which the short-term interest rate moves depends on the level of the rate. When the rate is very high, that direction is downward; when the rate is very low, it is upward.

Related Quotes

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

If a country is an attractive place for foreigners to invest their funds, then that country will have a relatively high exchange rate. If it's an unattractive place, it will have a relatively low exchange rate. Those are the fundamentals that determine the exchange rate in a floating exchange rate system.

What central banks can control is a base and one way they can control the base is via manipulating a particular interest rate, such as a Federal Funds rate, the overnight rate at which banks lend to one another. But they use that control to control what happens to the quantity of money. There is no disagreement.

As you know, you go to war with the army you have, not the army you might want or wish to have at a later time. Since the Iraq conflict began, the Army has been pressing ahead to produce the armor necessary at a rate that they believe - it's a greatly expanded rate from what existed previously, but a rate that they believe is the rate that is all that can be accomplished at this moment.