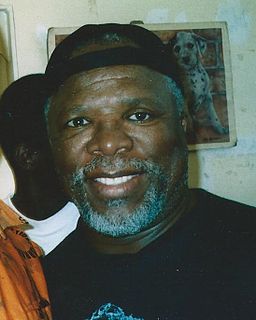

A Quote by John Kani

The exchange rate of the Rand against the dollar, pound or euro makes South Africa an attractive location. The positive side of this is it gives our artists and technicians an opportunity to work.

Related Quotes

If a country is an attractive place for foreigners to invest their funds, then that country will have a relatively high exchange rate. If it's an unattractive place, it will have a relatively low exchange rate. Those are the fundamentals that determine the exchange rate in a floating exchange rate system.

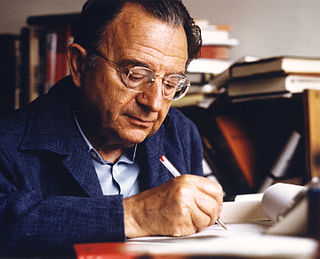

Our whole culture is based on the appetite for buying, on the idea of a mutually favorable exchange. .... For the man an attractive girl - and for the woman an attractive man - are the prizes they are after. 'attractive' usually means a nice package of qualities which are popular and sought after on the personality market. What specifically makes a person attractive depends on the fashion of the time, physically as well as mentally. ... Two persons thus fall in love when they feel they have found the best object available on the market, considering the limitations of their own exchange values.

Well, I don't like the UK. I haven't ever been a fan of the pound (sterling),

and even though they are taking some steps in the right direction - more so than the US - in addressing some of their problems, I still think they're doing it much too slowly. So, I think that the pound will continue to lose value relative to some of these other currencies. I ultimately expect the pound to rise against the dollar, but that's not the best way to take advantage of dollar weakness.

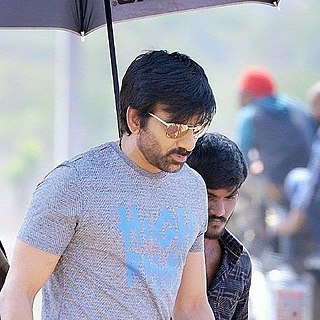

I want to do Hindi films, but a proper one and a good production. I'm even open to multi-starrers because those work better in Bollywood. But it should be with only Bollywood technicians, not the South Indian team. There's no point to my going to Bollywood if I work with the same artistes and technicians.

The problem is that, in a world of floating exchange rates, as Italy was before the euro, if one country is subjected to a shock which requires it to cut wages, it cannot do so with a modern kind of control and regulation system. It is much easier to do it by letting the exchange rate change. Only one price has to change, instead of many.

The lesson for Asia is; if you have a central bank, have a floating exchange rate; if you want to have a fixed exchange rate, abolish your central bank and adopt a currency board instead. Either extreme; a fixed exchange rate through a currency board, but no central bank, or a central bank plus truly floating exchange rates; either of those is a tenable arrangement. But a pegged exchange rate with a central bank is a recipe for trouble.