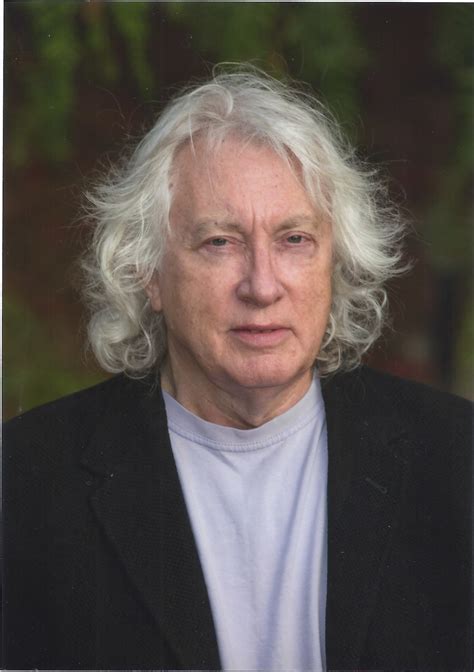

A Quote by John Kenneth Galbraith

No politician can praise unemployment or inflation, and there is no way of combining high employment with stable prices that does not involve some control of income and prices. Otherwise the struggle for more consumption and more income to sustain it-a struggle that modern corporations, modern unions and modern democracy all facilitate and encourage-will drive up prices. Only heavy unemployment will then temper this upward thrust. Not many wish to confront the truth that the modern economy gives a choice only between inflation, unemployment, or controls.

Quote Topics

Between

Choice

Combining

Confront

Consumption

Control

Controls

Corporations

Democracy

Does

Drive

Economy

Employment

Encourage

Facilitate

Gives

Heavy

High

Income

Inflation

Involve

Many

Modern

More

Only

Otherwise

Politician

Praise

Prices

Some

Stable

Struggle

Sustain

Temper

Then

Thrust

Truth

Unemployment

Unions

Up

Upward

Way

Will

Wish

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

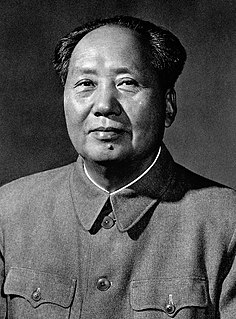

In China the struggle to consolidate the socialist system, the struggle to decide whether socialism or capitalism will prevail, will still take a long historical period. However, we should all realize that the new system of socialism will unquestionably be consolidated. We can assuredly build a socialist state with modern industry, modern agriculture, and modern science and culture.

In Europe and the United States the two decades following the Second World War will for long be remembered as a very good time, the time when capitalism really worked. Everywhere in the industrialized countries production increased. Unemployment was everywhere low. Prices were nearly stable. When production lagged and unemployment rose, governments intervened to take up the slack, as Keynes had urged.

The idea that when people see prices falling they will stop buying those cheaper goods or cheaper food does not make much sense. And aiming for 2 percent inflation every year means that after a decade prices are more than 25 percent higher and the price level doubles every generation. That is not price stability, yet they call it price stability. I just do not understand central banks wanting a little inflation.

The good thing about the dividend-paying stocks is, first of all you have stocks, which are real assets if we have some inflation. I think we're going to have 2%, 3% maybe 4%. That's a sweet spot for stocks. Corporations do well with that. It gives them pricing power. Their assets move up with prices. I'm not fearful of that inflation.

Here's why I think the public service jobs are almost unavoidable: When we have downturns in the economy - and we will, for we haven't repealed the business cycle - unemployment will build, yet we no longer have any safety net. What are we going to do? Unless we decide to pull out all the stops and lower interest rates immediately and risk turning a recession into wild inflation, we're going to have to figure out some way of providing some more, not job security, but employment security.