A Quote by John Kenneth Galbraith

The foresight of financial experts was, as so often, a poor guide to the future.

Related Quotes

Too often, it seems, conservatives have scorned experts as incompetent, biased, or otherwise worth ignoring because they came up with answers that didn't fit their politically desired answer. Often, they proclaim experts have a liberal bias. Of course, plenty of Democrats have voted for conservative ideas, but that is beside the point.

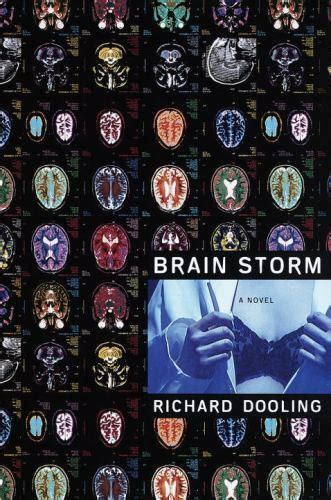

Anyone interested in the past, present, or future of banking and financial crises should read The Bankers' New Clothes. Admati and Hellwig provide a forceful and accessible analysis of the recent financial crisis and offer proposals to prevent future financial failures. While controversial, these proposals--whether you agree or disagree with them--will force you to think through the problems and solutions.

The generally accepted theory is that financial markets tend towards equilibrium, and...discount the future correctly. I operate using a different theory, according to which financial markets cannot possibly discount the future correctly because the do not merely discount the future; they help to shape it.