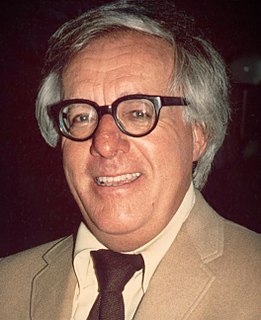

A Quote by John M. Ford

We're all living on borrowed time. The trick is to come up with works of sufficient interest to pay off the debt.

Related Quotes

People tend to think that paying a debt is like going out and buying a car, buying more food or buying more clothes. But it really isn't. When you pay a debt to the bank, the banks use this money to lend out to somebody else or to yourself. The interest charges to carry this debt go up and up as debt grows.

It is a well-settled principle of the international code that where one nation owes another a liquidated debt which it refuses or neglects to pay the aggrieved party may seize on the property belonging to the other, its citizens or subjects, sufficient to pay the debt without giving just cause of war.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

Avoid debt that doesn’t pay you. Make it a rule that you never use debt that won’t make you money. I borrowed money for a car only because I knew it could increase my income. Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

Negative effects on the economy were covered up with a flood of liquidity from the Fed. That,plus lax regulation, led to a housing bubble, a consumption boom - but we were living on borrowed money. It was inevitable that there would be a day of reckoning, and it has now come. We will be paying the costs "with interest".