A Quote by John Maynard Keynes

If farming were to be organised like the stock market, a farmer would sell his farm in the morning when it was raining, only to buy it back in the afternoon when the sun came out.

Related Quotes

A farm includes the passion of the farmer's heart, the interest of the farm's customers, the biological activity in the soil, the pleasantness of the air about the farm -- it's everything touching, emanating from, and supplying that piece of landscape. A farm is virtually a living organism. The tragedy of our time is that cultural philosophies and market realities are squeezing life's vitality out of most farms. And that is why the average farmer is now 60 years old. Serfdom just doesn't attract the best and brightest.

Speculators are obsessed with predicting: guessing the direction of stock prices. Every morning on cable television, every afternoon on the stock market report, every weekend in Barron's, every week in dozens of market newsletters, and whenever business people get together. In reality, no one knows what the market will do; trying to predict it is a waste of time, and investing based upon that prediction is a purely speculative undertaking.

When you buy enough stocks to give you control of a target company, that's called mergers and acquisitions or corporate raiding. Hedge funds have been doing this, as well as corporate financial managers. With borrowed money you can take over or raid a foreign company too. So, you're having a monopolistic consolidation process that's pushed up the market, because in order to buy a company or arrange a merger, you have to offer more than the going stock-market price. You have to convince existing holders of a stock to sell out to you by paying them more than they'd otherwise get.

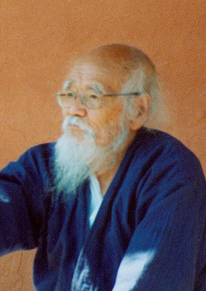

In my opinion, if 100% of the people were farming it would be ideal. If each person were given one quarter-acre, that is 1 1/4 acres to a family of five, that would be more than enough land to support the family for the whole year. If natural farming were practiced, a farmer would also have plenty of time for leisure and social activities within the village community. I think this is the most direct path toward making this country a happy, pleasant land.

I respect not his labors, his farm where everything has its price, who would carry the landscape, who would carry his God, to market, if he could get anything for him; who goes to market for his god as it is; on whose farm nothing grows free, whose fields bear no crops, whose meadows no flowers, whose trees no fruits, but dollars.

But though a funded debt is not in the first instance, an absolute increase of Capital, or an augmentation of real wealth; yet by serving as a New power in the operation of industry, it has within certain bounds a tendency to increase the real wealth of a Community, in like manner as money borrowed by a thrifty farmer, to be laid out in the improvement of his farm may, in the end, add to his Stock of real riches.