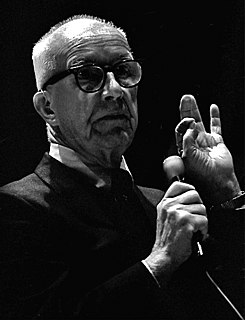

A Quote by John Maynard Keynes

It is investment, i.e. the increased production of material wealth in the shape of capital goods, which alone increases national wealth.

Related Quotes

Capital movements are no longer necessarily related to the production of goods and services. Through the financial markets of the world, capital movements today are overwhelmingly concerned with the capture of and trade in property rights, the ownership of assets that magnify a corporation's wealth, power, and control. It is what John Maynard Keynes described as "a casino world"-wealth without worth.

To control the production of wealth is to control human life itself. To refuse man the opportunity for the production of wealth is to refuse him the opportunity for life; and, in general, the way in which the production of wealth is by law permitted is the only way in which the citizens can legally exist.

Every time man makes a new experiment he always learns more. He cannot learn less. He may learn that what he thought was true was not true. By the elimination of a false premise, his basic capital wealth which in his given lifetime is disembarrassed of further preoccupation with considerations of how to employ a worthless time-consuming hypothesis. Freeing his time for its more effective exploratory investment is to give man increased wealth.

It was with the Industrial Revolution, as society plunged ever more eagerly into the conquest of material riches and bent all its energies to the accumulation of goods, that material poverty became a major problem. Obviously, this meant abandonment or downgrading of spiritual values, virtue, etc. To share or not to share in the increase of the collective wealth-this was the Number One question. It was the desire to acquire wealth that prompted the poor to start fighting.

A rentier is an investor whose relationship to a company or enterprise is strictly limited to the ownership of financial wealth (such as stocks or bonds) and the receipt of income on that wealth (such as dividends or interest). The financial system performs dismally at its advertised task, that of efficiently directing society's savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the allocation of capital, and has surprisingly little to do with real investment.

The information revolution has changed people's perception of wealth. We originally said that land was wealth. Then we thought it was industrial production. Now we realize it's intellectual capital. The market is showing us that intellectual capital is far more important that money. This is a major change in the way the world works. the same thing that happened to the farmers during the Industrial Revolution is now happening to people in industry as we move into the information age.