A Quote by John McEnroe

It seems like the richer you are, the more chance you have of paying less tax.

Related Quotes

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

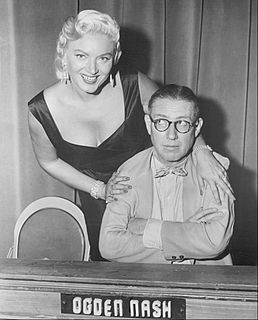

Abracadabra, thus we learn

The more you create, the less you earn.

The less you earn, the more you're given,

The less you lead, the more you're driven,

The more destroyed, the more they feed,

The more you pay, the more they need,

The more you earn, the less you keep,

And now I lay me down to sleep.

I pray the Lord my soul to take

If the tax-collector hasn't got it before I wake.

You can use the tax code to make people smoke less. You can use the tax code to make 'em smoke more. You can use the tax code to make 'em buy beer or buy less beer, more booze or less booze. You can screw the tax code around to make 'em make more charitable contributions. You think they're going to get rid of this power? Ain't no way, fool.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

Most people don't know this, but if you settle a debt for less than the amount you owed, you are potentially responsible for taxes on the forgiven debt. Look at it this way: You received goods and services for the full amount of debt, but you're only paying for a portion of it - sometimes less than 50%. Anything more than $600 is generally considered taxable, but the IRS will sometimes waive the tax if you can prove that your assets were less than your liabilities when the debt was settled.