A Quote by John Norquist

Related Quotes

Detroit's financial challenges - the decline of the American auto industry, the impact of the global economic recession, declining population, and an erosion of the municipal tax base - are key to understanding what led this great city to an inability to provide basic city services or to carry out the normal functions of a municipality.

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

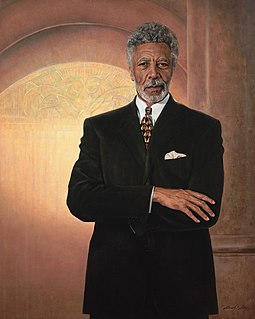

I decided that if nobody else was going to do anything to rectify this colossal inequity in taxation, I'd have to do it myself. So I instituted a suit against the city of Baltimore demanding that the city assessor be specifically ordered to assess the Church for its vast property holdings in the city, and that the city tax collector then be instructed to collect the taxes once the assessment has been made.