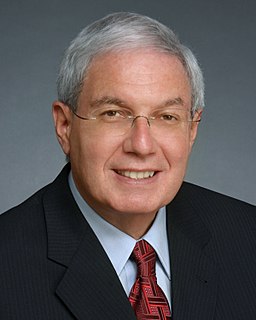

A Quote by John Podhoretz

Imagine his delight after it 'leaked' that he will propose raising taxes on the wealthy by $320 billion over the next 10 years, including increases to the capital gains and inheritance taxes.

Related Quotes

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

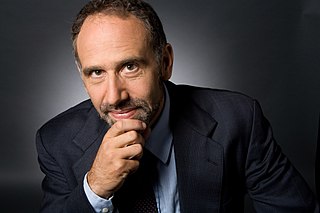

President Lyndon Johnson's administration was known for his War on Poverty. President Obama's will become notable for his War on Prosperity. We're speaking, of course, of Obama's plans to hike income taxes on the most wealthy 2 or 3 percent of the nation. He's not just raising the top rate to 39.6 percent; he's also disallowing about one-third of top earner's deductions, whether for state and local taxes, charitable contributions or mortgage interest. This is an effective hike in their taxes by an average of about 20 percent.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.