A Quote by John Romero

Related Quotes

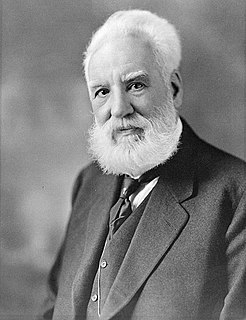

The investor with a portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances. He should always remember that market quotations are there for his convenience, either to be taken advantage of or to be ignored.

It can be shown that maximum diversification is achieved by holding each stock in proportion to its value to the entire market (italics added)... Hindsight plays tricks on our minds... often distorts the past and encourages us to play hunches and outguess other investors, who in turn are playing the same game. For most of us, trying to beat the market leads to disastrous results... our actions lead to much lower returns than can be achieved by just staying in the market.

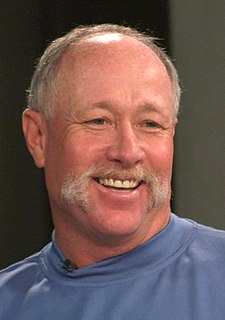

Hitting in a game is no different than hitting in a home run contest. It pisses me off to say Barry Bonds is the greatest hitter. He's playing in a wussy era. The game is soft. You never get thrown at today. Last thing a hitter has to worry about today is getting hit. The first thing Hank Aaron had to worry about is: Am I going to survive this at-bat because I'm black.