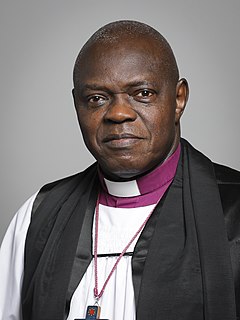

A Quote by John Sentamu

To a bystander like me, those who made 190 million pounds deliberately underselling the shares of HBOS, in spite of its very strong capital base, and drove it into the bosom of Lloyds TSB Bank, are clearly bank robbers and asset strippers.

Related Quotes

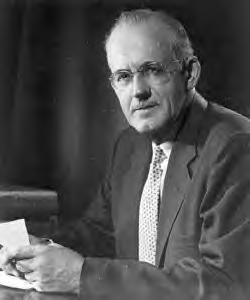

Nothing did more to spur the boom in stocks than the decision made by the New York Federal Reserve bank, in the spring of 1927, to cut the rediscount rate. Benjamin Strong, Governor of the bank, was chief advocate of this unwise measure, which was taken largely at the behest of Montagu Norman of the Bank of England....At the time of the Banks action I warned of its consequences....I felt that sooner or later the market had to break.

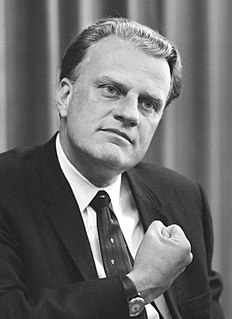

I went to the library and learned how checks work. I found out that routing numbers are like zip codes: the checks are sent to the bank that correlates to the routing number. If I manipulate those numbers to a bank far away, it would take longer to get back to the bank, which gave me more time to write more bad checks.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

I think one of the main challenges that the World Bank faces is creating an organizational structure that doesn't get in the way of its staff. We have fantastic staff. People told me as I was coming into the organization that the greatest asset of the World Bank Group is its staff, and I think there's no question that that's the case.

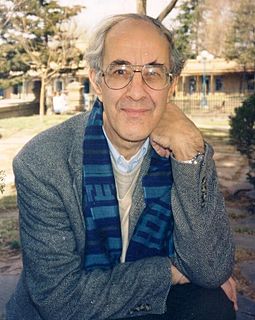

The lesson for Asia is; if you have a central bank, have a floating exchange rate; if you want to have a fixed exchange rate, abolish your central bank and adopt a currency board instead. Either extreme; a fixed exchange rate through a currency board, but no central bank, or a central bank plus truly floating exchange rates; either of those is a tenable arrangement. But a pegged exchange rate with a central bank is a recipe for trouble.