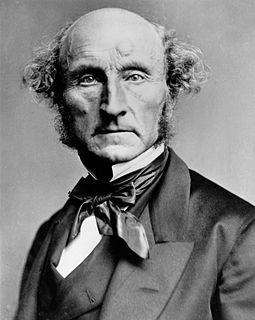

A Quote by John Stuart Mill

To tax the larger incomes at a higher percentage than the smaller, is to lay a tax on industry and economy; to impose a penalty on people for having worked harder and saved more than their neighbors.

Related Quotes

Fewer and fewer people are paying larger and larger percentage of the tax burden, as you know, almost half the people pay no income taxes at all. We're going to have more people in the wagon than we got pulling the wagon before long and that's not going to work. Those jobless numbers, you know, go hand-in-hand with those tax numbers.

Assuming that a tax increase is necessary, it is clearly preferable to impose the additional cost on land by increasing the land tax, rather than to increase the wage tax - the two alternatives open to the City (of Pittsburgh). It is the use and occupancy of property that creates the need for the municipal services that appear as the largest item in the budget - fire and police protection, waste removal, and public works. The average increase in tax bills of city residents will be about twice as great with wage tax increase than with a land tax increase.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.