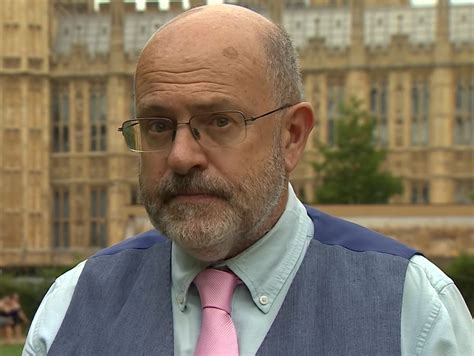

A Quote by John Sweeney

It's bad form to mention money-laundering. Instead, you talk about asset-management structures and tax beneficial schemes.

Quote Topics

Related Quotes

I think there are probably too many asset management companies in the world, and I think the place to be is either big or small. The area where it is probably more difficult to be is in the middle ground, where you've got that cost of regulation, you've got the cost of buying your own research, you've got all the costs of running an asset management company without the benefits of a big income producing asset.

Good money management alone isn't going to increase your edge at all. If your system isn't any good, you're still going to lose money, no matter how effective your money management rules are. But if you have an approach that makes money, then money management can make the difference between success and failure.

Hillary Clinton has decided to line up with John McCain in pushing to suspend the federal excise tax on gasoline, 18.4 cents a gallon, for this summer's travel season. This is not an energy policy. This is money laundering: we borrow money from China and ship it to Saudi Arabia and take a little cut for ourselves as it goes through our gas tanks. What a way to build our country.

My net worth is the market value of holdings less the tax payable upon sale. The liability is just as real as the asset unless the value of the asset declines (ouch), the asset is given away (no comment), or I die with it. The latter course of action would appear to at least border on a Pyrrhic victory.

Why, just a couple of economic seasons ago, was idle cash considered an indication of bad management or lazy management? Because it meant that management didn't have this money out at work ... Now look. Presto! A new fashion! Cash is back in! Denigrating liquidity has dropped quicker than hemlines. A management is now saluted if it has some cash, some liquidity, doesn't have to go to the money market at huge interest rates to get the wherewithal to keep going and growing. Along with Ben Franklin, my father and your father would understand and applaud this new economic fashion.