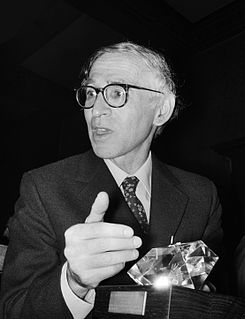

A Quote by John Templeton

It is only by understanding the emotion of others that an investor has a chance to produce superior results.

Related Quotes

The Obama administration's agenda of maximizing dependency involves political favoritism cloaked in the raiment of "economic planning" and "social justice" that somehow produce results superior to what markets produce when freedom allows merit to manifest itself, and incompetence to fail. The administration's central activity - the political allocation of wealth and opportunity - is not merely susceptible to corruption, it is corruption.

Pride is a mental factor causing us to feel higher or superior to others. Even our study of dharma can be the occasion for the delusion of pride to arise if we think our understanding is superior to that of everyone else. Pride is harmful because it prevents us from accepting fresh knowledge from a qualified teacher. Just as a pool of water cannot collect on the tip of a mountain, so too a reservoir of understanding cannot be established in a mind falsely elevated by pride.

A decade ago, I really did believe that the average investor could do it himself. I was wrong. I've come to the sad conclusion that only a tiny minority, at most one percent, are capable of pulling it off. Heck, if Helen Young Hayes, Robert Sanborn, Julian Robertson, and the nation's largest pension funds can't get it right, what chance does John Q. Investor have?

We are convinced that the intelligent investor can derive satisfactory results from pricing of either type (market timing or fundamental analysis via price). We are equally sure that if he places his emphasis on timing, in the sense of forecasting, he will end up as a speculator and with a speculator's financial results." And "The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices.