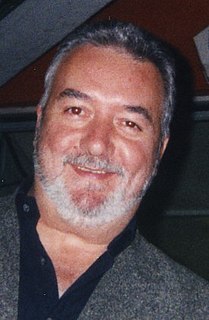

A Quote by John Virgo

The worst time was in 1985 when house prices crashed and interest rates went up to 14 percent. I was not winning on the snooker table and I had this big image to keep up - and a lifestyle where I lived beyond my means.

Related Quotes

By the age of 14, I had stopped doing homework and stopped studying - as soon as I had any spare time, I was up to the local snooker club. I was fortunate my parents never forced me to stop playing snooker and told me to carry on at school. Nowadays, that probably isn't the best advice. I basically had nothing else to fall back on.

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

In the U.S., you couldn't have job creation with interest rates of 30 or 40 percent. They had a philosophy that said job creation was automatic. I wish it were true. Just a short while after hearing, from the same preachers, sermons about how globalization and opening up capital markets would bring them unprecedented growth, workers were asked to listen to sermons about "bearing pain." Wages began falling 20 to 30 percent, and unemployment went up by a factor of two, three, four, or ten.

Sometimes I pick up the phone, listen to cold caller alias name, repeat it several times in an incredulous tone and then - bam! - pretend to recognise them. I ask them if they remember the hell of a time we had at the 1985 summer camp when we set fire to the wooden shed, and I keep making things up and go on and on until they end up terminating the call.

Interest rates are going to go up because employment is going to go up. If employment goes up, then our apartments get filled. And if employment goes up, our office buildings get filled. The reality is that increased economic activity combined with increased interest rates is basically bullish for real estate.