A Quote by Jon Huntsman, Jr.

At the end of the day, capital is a coward. It's going to flee from wherever it perceives risk to be present in the marketplace.

Quote Topics

Related Quotes

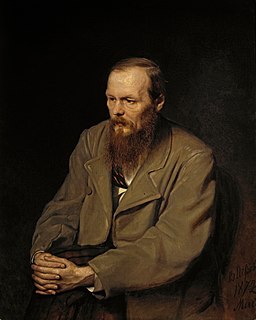

Every decent man of our age must be a coward and a slave. That is his normal condition. Of that I am firmly persuaded. He is made and constructed to that very end. And not only at the present time owing to some casual circumstance, but always, at all times, a decent man is bound to be a coward and a slave.

You reach peaks only to see there's another greater peak beyond it. Suddenly that one looks like it'd have a much better view. It's an endless cycle of going toward things that you think will provide you happiness. At the end of the day, right now, right here, wherever you are, you can make a choice to be present and happy and fulfilled.

Thus, the capital owner is not a parasite or a rentier but a worker - a capital worker. A distinction between labor work and capital work suggests the lines along which we could develop economic institutions capable of dealing with increasingly capital-intensive production, as our present institutions cannot.

We regard using [a stock's] volatility as a measure of risk is nuts. Risk to us is 1) the risk of permanent loss of capital, or 2) the risk of inadequate return. Some great businesses have very volatile returns - for example, See's [a candy company owned by Berkshire] usually loses money in two quarters of each year - and some terrible businesses can have steady results.