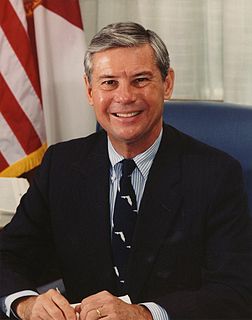

A Quote by Jon Kyl

The death tax is unfair, inefficient, economically unsound and, frankly, immoral.

Quote Topics

Related Quotes

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

I had nothing to do with death panels. I thought it was a horrible phrase about end of life. I didn't think it was accurate, and I was - I've always been opposed to it. The reason why I stood behind that phrase "death tax" for so many years is because the only time that you could pay that tax, the only time, is on the death of a relative. And that's what makes it a death tax. You have to be accurate.