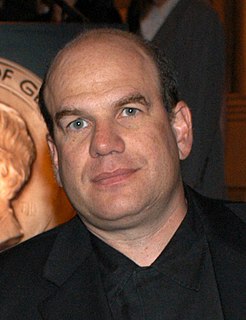

A Quote by Jon Oringer

Nobody is opposed to paying taxes; governments need to coordinate, work together and simplify the law.

Quote Topics

Related Quotes

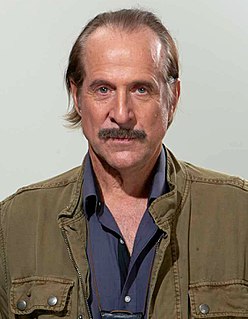

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

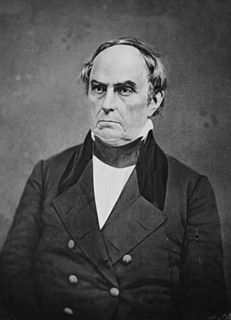

Nothing is more deceptive or more dangerous than the pretence of a desire to simplify government. The simplest governments are despotisms; the next simplest, limited monarchies; but all republics, all governments of law, must impose numerous limitations and qualifications of authority, and give many positive and many qualified rights.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

Remember that all tax revenue is the result of holding a gun to somebody's head. Not paying taxes is against the law. If you don't pay your taxes, you'll be fined. If you don't pay the fine, you'll be jailed. If you try to escape from jail, you'll be shot. ... Therefore, every time the government spends money on anything, you have to ask yourself, 'Would I kill my kindly, gray-haired mother for this?'

You have to seek the simplest implementation of a problem solution in order to know when you've reached your limit in that regard. Then it's easy to make tradeoffs, to back off a little, for performance reasons. You can simplify and simplify and simplify yet still find other incredible ways to simplify further.