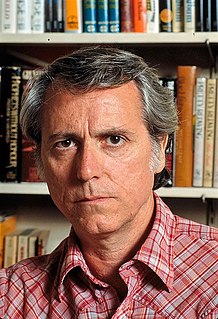

A Quote by Jonathan Galassi

The price of an e-book is a lot less than the price that we're charging for a hardcover book. It's about the same as we charge for a paperback. And that means a different revenue stream.

Related Quotes

I buy stocks when they are battered. I am strict with my discipline. I always buy stocks with low price-earnings ratios, low price-to-book value ratios and higher-than-average yield. Academic studies have shown that a strategy of buying out-of-favor stocks with low P/E, price-to-book and price-to-cash flow ratios outperforms the market pretty consistently over long periods of time.

This was an age before e-books. We all knew that the only way you can allow a book to survive in print in the long term is in paperback. The hardback has a certain life, and then it stops having that. It stops selling, and if you want the book to just stay around there has to be a paperback edition. So if there were not a paperback edition the book would eventually disappear from the shelves, and we would have lost the battle.

Edge also implies what Ben Graham....called a margin of safety. You have a margin of safety when you buy an asset at a price that is substantially less than its value. As Graham noted, the margin of safety 'is available for absorbing the effect of miscalculations or worse than average luck.' ...Graham expands, "The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price."

I would have never wanted to write another management book. There are so many of them, and everybody says the same thing about them, and they are all the same - they give the exact same advice. It's like a diet book; they all say eat less calories, exercise more, and every single book has the same conclusion.

Today you can buy the Dialogues of Plato for less than you would spend on a fifth of whiskey, or Gibbon's Decline and Fall of the Roman Empire for the price of a cheap shirt. You can buy a fair beginning of an education in any bookstore with a good stock of paperback books for less than you would spend on a week's supply of gasoline.