A Quote by Jonathan Meades

At any point in the world's history most architecture is going to be bad but I think there's been a collective mentality since the late Conservative years - the end of Thatcher/start of Major and certainly continued throughout New Labour and continuing now - that new is necessarily better, so there is this neophilia which isn't the vanguard of progress, it's just the vanguard of the construction industry enjoying itself.

Quote Topics

Related Quotes

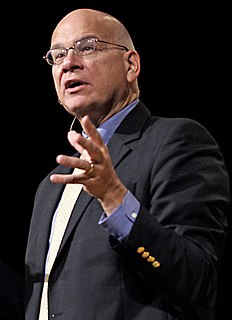

I think these younger Christians are the vanguard of some major new religious, social, and political arrangements that could make the older form of culture wars obsolete. After they wrestle with doubts and objections to Christianity many come out on the other side with an orthodox faith that doesn't fit the current categories of liberal Democrat or conservative Republican.

Continuous wars - which we have now had since 2001 - starting with Afghanistan, continuing on to Iraq. And even since Iraq, it's been more or less continuous. The appalling war in Libya, which has wrecked that country and wrecked that part of the world, and which isn't over by any means. The indirect Western intervention in Syria, which has created new monsters. These are policies, which if carried out by any individual government, would be considered extremist. Now, they're being carried out collectively by the United States, backed by some of the countries of the European Union.

Nothing highlights better the continuing gap between rhetoric and substance in British financial services than the failure of providers here to emulate Jack Bogle's index fund success in the United States. Every professional in the City knows that index funds should be core building blocks in any long-term investor's portfolio. Since 1976, the Vanguard index funds has produced a compound annual return of 12 percent, better than three-quarters of its peer group.