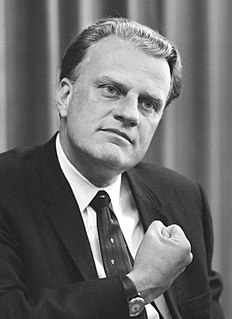

A Quote by Jonathan Sacks

The wisest rule in investment is: when others are selling, buy. When others are buying, sell. Usually, of course, we do the opposite. When everyone else is buying, we assume they know something we don't, so we buy. Then people start selling, panic sets in, and we sell too.

Related Quotes

Allowing short selling is allowing people to sell - instead of having to buy the stock and then sell it, which doesn't do much; allow them to sell it, and then buy it. In which case they can express that information and the idea is that you would get more accurate valuation of companies by letting people express both their positive information and their negative information through either long or short selling.

Buy less. Choose well. Make it last. Quality, not quantity. Everybody’s buying far too many clothesI mean, I know I’m lucky, I can just take things and borrow them and I’m just okay, but I hate having too many clothes. And I think that poor people should be even more careful. It doesn't mean therefore you have to just buy anything cheap. Instead of buying six things, buy one thing that you really like. Don't keep buying just for the sake of it.

I've had people say to me, "Well, how do I start collecting artworks?" Well, you start by buying. Buy what you like, buy what you can afford - and I'm not just saying that because I'm a dealer. You can't be so paralyzed to where you keep saying, "I've got to learn more." The best way to learn is to go home and actually put something on the wall. Then you've got an investment. Then you're living with it. Then you're in the game.

I don't really know what 'selling out' is exactly. I would sell out if I could, but nobody's buying it. I would love to go mainstream, but my comedy is too edgy. It's always too dirty. It's always too filthy. I'm dying to sell out. But I love doing comedy, I love touring, and I think I would do everything for free.

I do voiceovers, but being on-camera and selling something? I wasn't really interested. And then I thought, well, wait a minute. Everybody's selling something. When you turn on the tube... And then if you go to Europe or Asia, everyone is selling something. All the guys that don't want to be seen selling something here are selling something there. So I thought what the hell?

The reader can test his own psychology by asking himself whether he would consider, in retrospect, the selling at 156 in 1925 and buying back at 109 in 1931 was a satisfactory operation. Some may think that an intelligent investor should have been able to sell out much closer to the high of 381 and to buy back nearer the low of 41. If that is your own view you are probably a speculator at heart and will have trouble keeping to true investment precepts while the market rushes up and down.

With a profession such as investing, people see the 'doing' as the buying and selling. It is difficult to come home from work, and answer your spouse's question, 'what did you do today?' with 'well, I read a lot, and I talked a little.' If you're not buying or selling, you may feel you aren't doing anything.