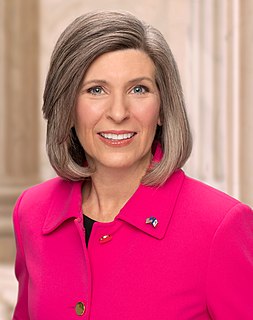

A Quote by Joni Ernst

In the U.S. Senate, in the short term we need to reduce the tax burden on hard working individuals, families, and small businesses.

Related Quotes

We also need to reduce corporate tax rates. This applies to small, medium and large businesses. At 35 percent, we have the second highest corporate rates in the world. It restricts the growth of small enterprises that need to plow capital back into their businesses and forces companies and jobs to move overseas.

My tax plan will cut taxes for 95 percent of workers, because we need to put money back into the pockets of struggling middle-class families and close the egregious tax loopholes that have exploded over the last eight years. My plan eliminates capital gains taxes entirely for the small businesses and start-ups that are the backbone of our economy, as opposed to John McCain's plan, which would tax these businesses. John McCain is running to serve out a third Bush term. But the truth is, when it comes to taxes, that's not being fair to George Bush.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.