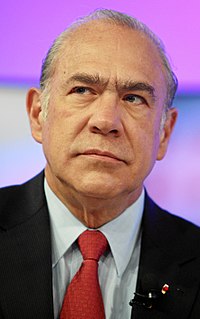

A Quote by Jose Angel Gurria

You do need more revenues, and you do need to cut expenses. But you also don't want to go in a direction whereby increasing taxes creates a reticence to create new jobs. You don't want to increase taxes on work. You don't want to increase taxes on investment and the creation of wealth.

Related Quotes

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.

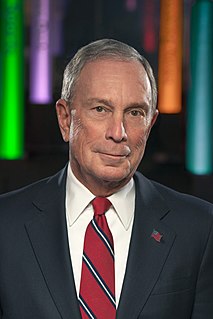

The United States of American business pays the second-highest business taxes in the world, 35 percent. Ireland pays 11 percent. Now, if you're a business person, and you can locate any place in the world, then, obviously, if you go to the country where it's 11 percent tax versus 35 percent, you're going to be able to create jobs, increase your business, make more investment, et cetera. I want to cut that business tax. I want to cut it so that businesses will remain in the United States of America and create jobs.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.