A Quote by Jose Angel Gurria

The concept of national treatment is a core component of investment and trade agreements. It promotes valuable competition on a level playing field. Investment treaties should not turn this idea on its head, giving privileges to foreign companies that are not available to domestic companies.

Related Quotes

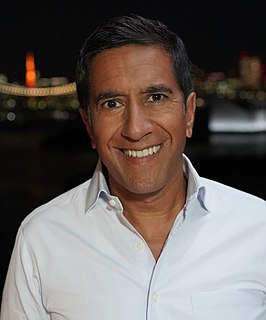

I am proud of the fact that the U.K. is an open trading country. I welcome inward investment such as that of Nissan, and the takeover of struggling British companies by foreign companies who turn them around, as in the case of Jaguar Land Rover. I also accept that job losses sometimes have to occur to restore failing companies to health.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

There is no question that an important service is provided to investors by investment companies, investment advisors, trust departments, etc. This service revolves around the attainment of adequate diversification, the preservation of a long-term outlook, the ease of handling investment decisions and mechanics, and most importantly, the avoidance of the patently inferior investment techniques which seem to entice some individuals.

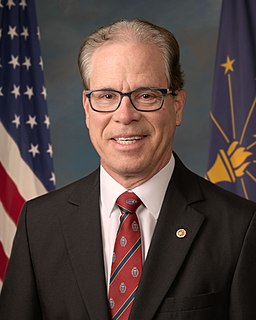

The potential of Mexico, Canada and the United States is enormous. We have a combined population of half a billion people; peaceful trade-friendly borders that are the envy of the world; the prospect of energy independence is within reach and will change the geopolitical situation of United States; we do a trillion dollars in trade among the three countries; more than 18,000 American companies are involved in foreign direct investment in Mexico and Canada; an increasing number of Mexican companies are creating jobs in the United States.

"No one is doing what we're doing." This is a bummer of a lie because there are only two logical conclusions. First, no one else is doing this because there is no market for it. Second, the entrepreneur is so clueless that he can't even use Google to figure out he has competition. Suffice it to say that the lack of a market and cluelessness is not conducive to securing an investment. As a rule of thumb, if you have a good idea, five companies are going the same thing. If you have a great idea, fifteen companies are doing the same thing.

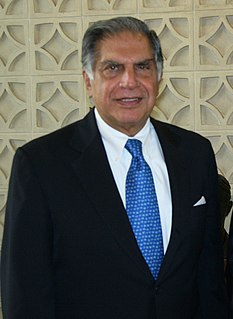

I do believe that India needs a lot more foreign direct investment than we've got, and we should have the ambition to move in the same league many other countries in our neighborhood are moving. We may not be able to reach where the Chinese are today, but there is no reason why we should not think big about the role of foreign direct investment, particularly in the areas relating to infrastructure, where our needs for investment are very large. We need new initiatives, management skills, and I do believe that direct foreign investment can play a very important role.

I've never believed protectionism of that kind will lead us anywhere. I think you can have certain specific rules for engaging with India.. for example, not allowing mineral resources to be taken out of the country.. but there is not a shred of doubt in my mind that when you open an economy you should do it in totality. Foreign investment adds a sense of competition; we should see this as a wake-up call to modernise and upgrade. Companies that do not will undoubtedly die.

We have worked to make our trade negotiations more transparent and to negotiate value-based agreements. We have listened to concerns, for example by carrying out a reform of the investment protection system and setting out to create a multilateral investment court. Our world is rapidly changing and this creates a multitude of concerns.